Evaluation Of Intellectual Property As A Key Asset In M&A Transactions

A merger, in its simplest form, means combining two broadly equal companies' assets and the formation of a new legal entity, while an acquisition is either a hostile or a friendly takeover of one company by another by purchasing either a majority stake (≥51%) or the entirety of its ownership stake. M&A has been used as the fastest and steadiest tool to grow companies and is a way to eliminate competition and enhance profitability. During mergers and acquisitions, the most important aspect the companies emphasize on is the intellectual property and its rights owned by the target company.

Intellectual property, in simple terms, can be defined as intellectual and intangible assets of the company, such as patents, trademarks, trade secrets, designs, etc. More often than not, the primary purpose of a merger or acquisition is to acquire the rights to exploit the target company's IP. This article evaluates how IP proves to be a major asset in the valuation of the target company's market value and the issues that follow while transferring such rights and ownership of the intellectual property.

M & A: A Tool To Survive The Rising Competition

Why do companies merge? The very purpose behind any merger or acquisition is to grow, reconstruct, and maximize profits in order to keep up with the company's standards in the global market. Moreover, mergers can also easily expand their consumer base by eliminating competition and by sustaining profitability.Developing new technologies and strategies in order to grow often requires a lot of time and resources. M&A gives an easy way out by providing the acquiring company control over all the tangible as well as intangible assets of the target company.

When companies merge, they not only tend to share their assets but also their customer base, and this builds up goodwill, productivity, and net worth for the companies. One of the most significant horizontal mergers in recent times is between Vodafone and Idea, leading to the formation of a new legal entity, "Vi".

The merger was an attempt to fight the dominance and the competitive pricing policies of Reliance Jio. Vodafone India and Idea's individual market shares were very low compared to Bharti Airtel and Reliance Jio. After the merger, they saw a significant rise in their subscribers. The Vodafone-Idea Ltd merger has created a telecom giant and is expected to leave Bharti Airtel behind in the ongoing telecom competition. This is a classic example of battling rising competition in an ever growing market.

How Intellectual Property Fuels M&A Transactions

When two companies merge, all the tangible and intangible assets of one company become part of the acquiring company's assets as well. Furthermore, one of the most valuable intangible assets is intellectual property and its rights. As already mentioned earlier, for decades, the primary reason for a majority of mergers or acquisitions has been the Fortune companies' desire to acquire unique IP, i.e., trademarks, patents, copyrights, trade secrets, and know-hows.Especially for technology and biotech companies, the company's IP forms the core part of the company's assets. It is no news that IP is increasingly driving M&A activities given that IP continues to constitute most of a company's value. An example of the same would be the acquisition of InterTrust Technologies.

InterTrust Technologies, founded in 1990 held a strong business in digital market rights. The business failed after certain initial success. But on the other hand, InterTrust had developed a strong patent portfolio in the digital market rights. InterTrust was purely an IP holding company when it was put up for sale. It didn't have any customers, assets, or revenue. It only held patents and a patent infringement suit against Microsoft. It was soon acquired by Fidelio, a joint venture by Sony, Philips and others for US $453 million.

This is a clear example of a purely IP driven M&A. Across many technology industries, merger is a pathway to capture top innovators, scientists, knowledge and to buy a collection of legal rights on the IP assets. This practice is not just limited to tech firms; it has rapidly spread to companies growing for decades purely on their own innovations and product developments for the following reasons:

Reduces research and development costs:

In today's growing market with new technologies continuously being developed, acquiring already existing technologies rather than spending a fortune on labor costs is the easier option to increase the productivity as well as assets of the company.

Diversification to various sectors:

A strong IP portfolio of the target company helps the acquiring company when it is aiming to expand and enhance its IP portfolio into diverse sectors. Acquiring pre-existing resources while exploring new sectors in the market is not only cost-efficient but also provides a more diverse portfolio to the acquirer.

Adds Value to the company portfolio:

While merging or acquiring, the purchaser becomes vested with all the intellectual property of the selling company and all the goodwill attached to it. Which directly adds value to the acquiring company. For example, Walmart did not change the trade name or the corporate name of Flipkart specifically because of the goodwill attached to the name (trademark) of Flipkart. Moreover, the acquisition of Motorola by Google Inc., giving it complete control over Motorola's patents, is an apt example of value addition to a company's asset portfolio.

Transfer of technology: Technology transfer between parties to the merger or acquisition is another significant role IP plays in M&A transactions. It helps parties utilize their joint assets and resources in the form of intellectual property to their full extent and allows proper exploitation.

Valuation Of IP Portfolio

Valuation of intellectual property rights simply means arriving at a fair value for a company's intellectual property that can be monetized and can leverage the ultimate selling price. Putting a value on the IP asset becomes necessary in order to sell, license, or enter into any commercial transactions based on IP. Especially when the merger includes acquiring the IP assets of the target company, determining the monetary value of the IP portfolio of the target company becomes extremely important.Methods of valuation of IP assets:

There are primarily three methods of valuing intellectual property assets, which are as follows:

Income Method:

It's the most commonly used method to value IP. This method relies on future revenue expected to be generated from the IP as against its present value. This approach significantly focuses on every parameter that is related to earning capacity of an IP. The most accurate estimations can be made based on past revenue generated by the IP.

Market Method:

This method depends on market behavior and third party transactions of similar IP taking place in the market. IP valuation is influenced by prices paid for other similar transactions. This is slightly less reliable as it is subject to accurate and effective information for sound comparison and can only be relied on if correct data is available.

Cost Method:

This method uses the principle of evaluating the cost incurred in creating the IP. This method is usually used when the IP does not produce any economic benefits. This method is further divided into two kinds of methods. Replacement cost method and reproduction cost method. In the replacement cost method, the cost incurred in creating the same IP is calculated, and in the reproduction cost method, the cost incurred in generating IP with similar properties is calculated.

Due diligence before acquiring IP assets in M & A:

Due to the information gap between the parties, due diligence is critical for IP transactions. It all starts with a Memorandum of Understanding, where both parties agree to share information, plans, trade secrets, and other documents. A non-disclosure agreement should be signed if the IP contains any trade secrets or customer information. Due diligence is used to calculate the technological, legal, and financial elements of the target company.

Due diligence of IP not only benefits buyers, but it also benefits sellers by reassuring them that they're not paying to keep some unused IP and informs sellers of any potential risk or issue regarding IP that may inhibit sales. In addition, the due diligence analysis should look into whether a target company's trademark rights have any territorial or product market restrictions. True due diligence is carried out by legal and financial experts in the form of a due-diligence report.

This report is duly made after a thorough check on various factors of the existing IP as mentioned below:

- IP asset identification

- IP asset assessment

- Third-party assertions

- Examination of suspected infringements

- IP term and territory check

Risk of unsound due diligence

Intellectual property assets, particularly in fast-expanding high-tech businesses, can be particularly challenging to value effectively in mergers and acquisitions. Failure to conduct a thorough IP Due Diligence Report has resulted in the demise of several acquired companies. Undoubtedly, intellectual property is one of the most widely cited causes of M&A failure, as made evident by the "Winner's Curse," in which the acquiring firm ends up paying more than market rate for the target firm during the bidding wars and subsequently fails to achieve even a minimum return on its investment. This is often a result of unsound due diligence where target firms are highly overvalued because of their knowledge assets.

An example of faulty due diligence leading to a M&A blunder would be the 1998 takeover of Rolls-Royce. For a hefty US $780 million, Volkswagen acquired the facility, the auto designs, and a variety of tangible assets like premises. Soon they came to know that the Rolls-Royce trademark was controlled by Rolls-Royce PLC and that it had transferred the trademark to BMW for US $66 million. As a result, Volkswagen owned the Rolls-Royce business but couldn't use its name.

Key Issues Affecting M & A In Connection With Intellectual Property

Intellectual property issues are equally important factors to be considered in M & A deals. There are a number of issues that should be addressed beforehand in pre-transaction IP due diligence. In particular, private tech and biotech companies often involve significant IP issues, essentially because they have not been subject to the scrutiny of public markets. The success of the sale depends on thorough due diligence of the selling company's intellectual property. Some of the key issues that typically occur during these transactions are briefly discussed below.Identification of IP: Intellectual property includes various forms. But the most significant assets include patents, trademarks, copyrights, trade secrets, software, etc. The initial challenge in these transactions is to identify the relevant IP essential to the growth and potential diversification of the acquiring company's business. Once these relevant IPs are identified, it becomes easier for investors and acquirers to evaluate and address any complexity in transfer or any risk associated with the IP.

Development and Ownership of IP: It is common for companies without proper representation during the transaction to discover uncertainties about their key IP's ownership. The most basic method of verifying ownership is by searching registration databases, depending on the registering authority.

If the IP has been jointly developed with another party, it may restrict the transfer and the acquiring company may be mandated to share the ownership of the IP. Another example of an ownership issue is whether the target company depends on third-party licenses and if it'll survive the transaction.

Representation and warranties: Representation and Warranties are key to protect buyers from potential breach. Buyers basically seek warranty in order to make sure the selling company is not infringing on any other party's rights, and similarly, no third party is violating the selling company's rights.

It is a common practice that if the buyer finds out any misrepresentation or false warranty, the acquirer may no longer be obligated to consummate the transaction. Moreover, the acquirer may also be entitled to seek compensation for damages. Buyers will simply limit their liabilities to post-closing litigation and claims, only exposing themselves to issues within the acquirer's knowledge.

Open Source Software: Often, when the target is a technology company, the target's software is an essential asset for the acquirer. The use of open source software by engineers to develop technology is common, and it often raises a number of issues and risks associated with it. One example would be that the use of OSS requires the source code for any modifications made to be generally available to third party users.

It also requires distributors to license its software under the same conditions as the open source license. It acts as a deal-breaker for an acquirer counting on the ability to exclusively exploit the software. Open source audits done as a part of due diligence to analyze any risk involved with the use of open source are an advised precaution.

Increasing Significance Of Ip Over The Years

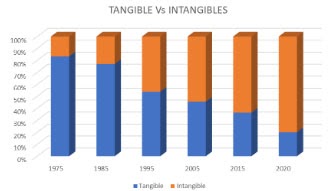

Investment bankers tend to separate the tangible and intangible properties of the target company when evaluating its equity value, giving them a clear perspective. Properties developed out of intellect are the pure form of gold in the company's treasure trove. In today's modern era, IP accounts for 80% of total assets acquired by any company.Buildings, equipment, cash, inventory, and land are examples of a company's tangible assets. On the other hand, intangible properties of a company include patents, brand value, customer data, software, logos, etc. Between 1985 and 1995, there was a significant shift in corporate strategy, with most companies opting for intangible assets over tangible assets.

The following graph depicts the significant increase in intangible property valuation over time, including patents, trademarks, designs, trade secrets, and so on:

Figure 1: Intangible assets account for 80% of total assets in the

Fortune 500.

Source: https://www.visualcapitalist.com/the-soaring-value-of-intangible-assets-in-the-sp-500/

Conclusion

When it comes to mergers and acquisitions, intellectual property is the most

critical factor to consider. Mergers and Acquisitions are beneficial to a

company's operations and capabilities, but they are incomplete without obtaining

the acquiring company's intellectual property rights.

Despite being intangible, the purchasing company's intellectual property rights

aid in the company's growth, diversification, and expansion.The acquisition of a

company's IP assets is critical to its survival, and it must be done with

thorough diligence. Otherwise, a business's IP portfolio might become a burden

for an acquiring company.

References:

- Intellectual Property Assets in Mergers and Acquisition by Lanning Bryer and Melvin Simensky

- Law Relating to Intellectual Property by Dr. B.L. Wadehra

- 13 Key Intellectual Property Issues In Mergers And Acquisitions : https://www.forbes.com/sites/allbusiness/2016/03/17/13-key-intellectual-property-issues-in-mergers-and-acquisitions/?sh=3b81eafe3f4e

- India: Value Estimation Of Intellectual Property: Techniques, Methods And Parameters: https://www.mondaq.com/india/trademark/943398/value-estimation-of-intellectual-property-techniques-methods-and-parameters

- The evolving role of intellectual property in M&A transactions by Nader A Mousavi: https://www.sullcrom.com/siteFiles/Publications/Mousavi-IAM-July-Aug-2011.pdf

Law Article in India

Lawyers in India - Search By City

Popular Articles

How To File For Mutual Divorce In Delhi

How To File For Mutual Divorce In Delhi Mutual Consent Divorce is the Simplest Way to Obtain a D...

Increased Age For Girls Marriage

It is hoped that the Prohibition of Child Marriage (Amendment) Bill, 2021, which intends to inc...

Facade of Social Media

One may very easily get absorbed in the lives of others as one scrolls through a Facebook news ...

Section 482 CrPc - Quashing Of FIR: Guid...

The Inherent power under Section 482 in The Code Of Criminal Procedure, 1973 (37th Chapter of t...

Home | Lawyers | Events | Editorial Team | Privacy Policy | Terms of Use | Law Books | RSS Feeds | Contact Us

Legal Service India.com is Copyrighted under the Registrar of Copyright Act (Govt of India) © 2000-2026

ISBN No: 978-81-928510-0-6

Please Drop Your Comments